Stop Foreclosure to Keep Your Home

Foreclosure can be an overwhelming and distressing experience for homeowners. When you fall behind on your mortgage payments, the lender may start the legal process to reclaim your property. However, foreclosure doesn’t have to be the inevitable end. With the right approach, you can explore various options to stop foreclosure and keep your home.

In this actual guide, we will walk you through the foreclosure process, how to assess your situation, and all the potential solutions available to prevent foreclosure. We will also explore various government programs, legal protections, and real-life examples to help you understand how to navigate this difficult situation and achieve the best outcome.

What is Foreclosure?

Foreclosure is the legal process by which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments. Typically, this involves the lender selling the property to recover the owed debt. Foreclosure is not a simple or quick process, and it can severely damage your credit score.

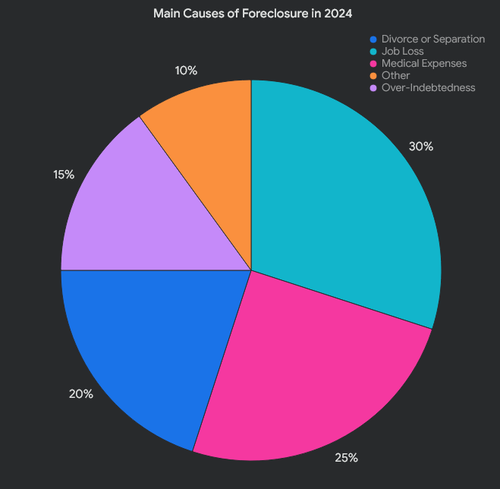

Why Do Foreclosures Happen?

There are numerous reasons why homeowners fall behind on their mortgage payments, and they don't always reflect poor financial management. Here are some of the most common causes of foreclosure:

- Job Loss: Losing your job is one of the most significant financial setbacks a person can experience. Without income, paying your mortgage becomes nearly impossible.

- Medical Expenses: Unexpected medical bills can quickly overwhelm your finances, especially if they’re not covered by insurance or if you don’t have an emergency fund.

- Divorce or Separation: Divorce often leads to a loss of household income, which can strain finances and lead to missed mortgage payments.

- Natural Disasters: In some cases, a home may be damaged by a flood, earthquake, or other natural disaster. Even if the home is insured, recovery can take time, during which mortgage payments may be missed.

- Overleveraging: Taking on too much debt, such as credit cards or other loans, can reduce your ability to make mortgage payments.

- Property Taxes: Failing to pay property taxes can also result in foreclosure, as tax authorities may seize the property.

The Foreclosure Process: Step-by-Step

Understanding the foreclosure process is crucial to knowing when to act. The process may vary from state to state, but it generally follows these steps:

- Missed Payments and Notice of Default: Typically, a lender will start by sending you notices when you miss payments. After a few months of missed payments, the lender will send a formal Notice of Default (NOD). This notice marks the official beginning of the foreclosure process.

- Pre-Foreclosure: After receiving the NOD, homeowners typically have a grace period in which they can make up missed payments. During this period, you may also negotiate with your lender for a loan modification, repayment plan, or other alternatives.

- Foreclosure Sale: If no resolution is found during pre-foreclosure, the property will go to auction, where the home is sold to recover the outstanding debt.

- Post-Foreclosure: If the property doesn’t sell at auction, it becomes the property of the lender, and this is known as Real Estate Owned (REO) property.

It’s important to act quickly if you receive a Notice of Default, as each step in the process gives you fewer options to stop foreclosure.

Step 1: Assess Your Financial Situation

Before you can take action, it’s essential to get a clear picture of your finances. This will help you make informed decisions about your options and what you can afford.

Review Your Income and Expenses

To determine how much you owe, how much you can afford to pay, and how much money you need to stay current on your mortgage, you must create a detailed budget. This budget will help you identify areas where you can cut costs and redirect money toward your mortgage.

Understand the Cause of Your Financial Problems

Whether it’s job loss, divorce, or another financial setback, identifying the root cause will help you figure out the best way to proceed. Once you understand what caused your financial issues, you can develop a strategy to address them.

Calculate What You Can Afford

Even if you can’t pay the full amount of your mortgage, determining what you can afford is crucial. If necessary, you can negotiate with your lender to create a payment plan or modify the loan.

Step 2: Communicate with Your Lender

The most critical action you can take to stop foreclosure is to open communication with your lender. Most lenders would prefer to work with you than to go through the lengthy foreclosure process.

Reach Out Early

Contact your lender as soon as you know you’ll have trouble making payments. Most lenders have teams dedicated to helping homeowners in financial distress. If you wait too long, you may miss out on options that could help you avoid foreclosure.

Loan Modifications

A loan modification may be an option if you’re struggling to make your current mortgage payments. Loan modifications can include changes like reducing the interest rate, extending the term of the loan, or deferring payments until you can catch up. Loan modifications can provide immediate relief by lowering your monthly payments.

Step 3: Consider Foreclosure Assistance Programs

Several government programs are available to help homeowners who are facing foreclosure.

The Making Home Affordable Program (MHA)

The Making Home Affordable program is a government initiative that includes two primary options for homeowners in distress:

- Home Affordable Modification Program (HAMP): HAMP is designed to help homeowners modify their mortgage to make it more affordable.

- Home Affordable Refinance Program (HARP): This program is for homeowners who owe more than their property is worth and are struggling to refinance.

Both programs aim to reduce mortgage payments and provide homeowners with an opportunity to stay in their homes.

Homeowner Assistance Fund (HAF)

State-specific funds are available to homeowners who were financially impacted by the COVID-19 pandemic. These funds may help you pay past-due mortgage payments and prevent foreclosure.

State and Local Assistance Programs

In addition to federal programs, some states and local governments have their own foreclosure prevention programs. For example, California has the California Foreclosure Prevention Act, which offers homeowners options to stay in their homes.

Step 4: Legal Protections Against Foreclosure

In some cases, there are legal protections that may help you avoid foreclosure.

Federal Protections

- Moratoriums on Foreclosures: During the COVID-19 pandemic, federal moratoriums on foreclosures were introduced. While these moratoriums have expired in most cases, they may be reinstated in times of national crisis.

- The Fair Debt Collection Practices Act (FDCPA): If your lender or a collection agency is harassing you or violating any rules, you may have the right to take legal action against them.

State-Specific Foreclosure Protections

Some states offer additional protections for homeowners facing foreclosure. For example, in New York, foreclosures must go through the court system, which can provide additional time and opportunities to challenge the foreclosure.

Step 5: Explore Alternatives to Foreclosure

If staying in your home isn’t an option, there are several alternatives that may be less damaging than foreclosure.

Deed-in-Lieu of Foreclosure

A deed-in-lieu of foreclosure is an agreement where you give your lender the deed to your home in exchange for debt cancellation. It’s often a quicker, more straightforward process than foreclosure, and it can protect your credit score.

Short Sale

A short sale occurs when your lender allows you to sell your home for less than you owe on the mortgage. The lender agrees to accept the proceeds from the sale as full payment, and you avoid foreclosure. While it can still impact your credit score, it may be a better option than a foreclosure.

Sell the Home

If your home has equity, selling it may be a viable option. You can use the proceeds to pay off the mortgage, potentially avoiding foreclosure altogether.

Step 6: Seek Legal Help and Professional Advice

In some cases, it may be beneficial to seek the help of professionals.

Hire an Attorney

A foreclosure defense attorney can help protect your rights, ensure you are following the correct legal process, and even help you challenge the foreclosure if there are errors or violations on the part of the lender.

HUD-Approved Housing Counselors

A HUD-approved housing counselor can provide valuable advice, help you understand your options, and work with your lender on your behalf. They can also assist with applying for government programs.

State-by-State Comparison: Foreclosure Laws and Assistance Programs

The foreclosure process varies from state to state, with each state having its own specific laws, procedures, and protections for homeowners. Understanding the differences in foreclosure laws and available assistance programs is crucial for homeowners looking to avoid foreclosure. Below, we compare the foreclosure processes, timelines, and protections available in various states across the U.S.

California: Judicial vs. Non-Judicial Foreclosure

Foreclosure Type: Non-Judicial

Foreclosure Timeline: Typically 6 months to 1 year

Foreclosure Protections:

- In California, the lender can begin the foreclosure process without going to court (non-judicial foreclosure).

- Homeowners must receive a Notice of Default (NOD) after missing three payments.

- The homeowner has the opportunity to reinstate the loan by paying the overdue amount within 90 days of receiving the NOD.

- California’s Homeowner Bill of Rights provides protections against dual tracking (when a lender starts foreclosure proceedings while you are in the process of applying for a loan modification).

Assistance Programs:

- California Mortgage Relief Program: Provides financial assistance to homeowners who have fallen behind on their mortgage due to COVID-19 or other financial hardships.

- Keep Your Home California: A program that offers financial assistance for mortgage payments and provides other foreclosure prevention services.

New York: Judicial Foreclosure

Foreclosure Type: Judicial

Foreclosure Timeline: 1 to 3 years

Foreclosure Protections:

- New York is a judicial foreclosure state, meaning the lender must file a lawsuit in court to begin the foreclosure process.

- Homeowners are given 90 days to reinstate the loan after the lender files a Notice of Default.

- New York law requires that homeowners receive a Notice of Foreclosure from the lender at least 90 days before starting a lawsuit.

- The foreclosure process is often longer than in other states, providing more time for homeowners to explore alternatives to foreclosure.

Assistance Programs:

- New York State Mortgage Assistance Program (NYS MAP): Offers financial assistance to homeowners who are struggling with mortgage payments.

- Homeowner Protection Program (HOPP): Provides free legal help and financial counseling to homeowners facing foreclosure.

Florida: Judicial Foreclosure with Limited Protections

Foreclosure Type: Judicial

Foreclosure Timeline: Typically 6 months to 1 year

Foreclosure Protections:

- Florida is a judicial foreclosure state, meaning the lender must file a lawsuit in court to initiate the foreclosure process.

- Homeowners have 20 days to respond to the lawsuit once it has been filed.

- In Florida, there is no mandatory mediation for foreclosure cases, which can make it harder for homeowners to work out a deal with their lender.

- While homeowners do have the opportunity to defend against foreclosure, the lack of mediation can limit their options.

Assistance Programs:

- Florida Hardest Hit Fund: A foreclosure prevention program that provides financial assistance to homeowners who have lost income due to unemployment or underemployment.

- Foreclosure Defense Counsel: Homeowners in Florida can access free legal help through programs like the Florida Legal Services’ Foreclosure Defense Project, which offers assistance for those who cannot afford private legal counsel.

Texas: Non-Judicial Foreclosure with Quick Process

Foreclosure Type: Non-Judicial

Foreclosure Timeline: As little as 60 days

Foreclosure Protections:

- Texas is a non-judicial foreclosure state, meaning the lender does not have to go to court to initiate the foreclosure process.

- Lenders are required to send a Notice of Default and give the borrower 20 days to catch up on missed payments.

- After the 20-day notice period, the lender can schedule a foreclosure auction, which usually takes place within 21 days.

- Texas does provide some protections for homeowners, including a right of redemption, but this only applies to tax foreclosures, not mortgage foreclosures.

Assistance Programs:

- Texas Homeowners Assistance Fund: Provides assistance for mortgage payments and other homeownership-related expenses, especially for homeowners affected by COVID-19.

- Texas Foreclosure Prevention Program: Helps homeowners avoid foreclosure through loan modifications, counseling, and other support services.

Nevada: Judicial Foreclosure with Protections Against Foreclosure Abuse

Foreclosure Type: Judicial

Foreclosure Timeline: 6 to 12 months

Foreclosure Protections:

- Nevada requires judicial foreclosure, so the lender must file a lawsuit to start the process.

- Homeowners have a 90-day period to cure the default after receiving a Notice of Default.

- Nevada has strong protections against foreclosure abuse. For example, lenders are required to verify that they have the right to foreclose before proceeding with the auction.

- Homeowner’s Bill of Rights in Nevada requires lenders to provide alternatives to foreclosure before moving forward with a sale.

Assistance Programs:

- Nevada Homeowner Assistance Fund: Provides assistance to homeowners affected by the pandemic, including paying past-due mortgage payments to prevent foreclosure.

- Home Affordable Modification Program (HAMP): Homeowners in Nevada can apply for HAMP, which provides loan modifications to reduce payments.

Illinois: Judicial Foreclosure with Long Process

Foreclosure Type: Judicial

Foreclosure Timeline: 1 to 3 years

Foreclosure Protections:

- Illinois follows the judicial foreclosure process, meaning the lender must go through the court system to foreclose.

- Homeowners have 90 days to bring their loan current after receiving a Notice of Default, but they may also request a loan modification.

- Illinois also has Mandatory Mediation in many counties, where the homeowner is required to meet with the lender before a foreclosure sale can occur. This gives homeowners more time to negotiate a solution and can often result in a loan modification or short sale.

Assistance Programs:

- Illinois Hardest Hit Program: Offers financial help to homeowners who are struggling with mortgage payments due to job loss or other financial hardships.

- Illinois Foreclosure Prevention Network: Offers free counseling services to homeowners facing foreclosure, helping them negotiate with lenders to find a solution.

Georgia: Non-Judicial Foreclosure with Quick Process

Foreclosure Type: Non-Judicial

Foreclosure Timeline: 4 to 6 weeks

Foreclosure Protections:

- Georgia uses a non-judicial foreclosure process, meaning the lender does not need to go through the court system to initiate foreclosure.

- The foreclosure process is much quicker in Georgia compared to judicial states. Once the lender sends the Notice of Default, they must wait at least 30 days before proceeding to sale.

- The right of redemption is not available to homeowners in Georgia, and the foreclosure process can be finalized quickly, making it more challenging for homeowners to catch up.

Assistance Programs:

- Georgia Hardest Hit Fund: Provides financial assistance to homeowners who have fallen behind on mortgage payments, particularly for those affected by unemployment or underemployment.

- Georgia Foreclosure Prevention Program: Offers free counseling and legal services to homeowners who are struggling to keep their homes.

Ohio: Judicial Foreclosure with Mediation Options

Foreclosure Type: Judicial

Foreclosure Timeline: 6 to 12 months

Foreclosure Protections:

- Ohio follows a judicial foreclosure process, meaning the lender must file a lawsuit in court.

- Homeowners can request foreclosure mediation through the courts, which provides an opportunity to negotiate with the lender and potentially avoid foreclosure.

- Ohio law requires lenders to work with homeowners to find alternatives to foreclosure, such as loan modifications or repayment plans, before proceeding with a foreclosure.

Assistance Programs:

- Ohio Homeowner Assistance Fund: Helps homeowners who have fallen behind on their mortgage due to the financial impact of the COVID-19 pandemic.

- Ohio Foreclosure Prevention Program: Offers foreclosure counseling and legal assistance to help homeowners navigate the foreclosure process.

Michigan: Judicial Foreclosure with State-Specific Protections

Foreclosure Type: Judicial

Foreclosure Timeline: 6 to 12 months

Foreclosure Protections:

- Michigan uses judicial foreclosure, where lenders must go through the court system.

- Homeowners are entitled to a redemption period after the foreclosure sale, which can last up to 6 months, depending on the type of property.

- The state offers protections that allow homeowners to remain in their homes during the redemption period, giving them more time to find a solution.

Assistance Programs:

- Michigan Hardest Hit Fund: A program that provides financial assistance to homeowners facing foreclosure due to unemployment or other financial difficulties.

- Michigan Foreclosure Prevention Program: Offers free foreclosure counseling, loan modifications, and legal help to homeowners at risk of foreclosure.

The foreclosure process and available assistance programs vary significantly from state to state. While some states have fast-tracked, non-judicial foreclosure processes, others offer extensive judicial protections that give homeowners more time to resolve their situation. Many states also provide specialized foreclosure prevention programs to help homeowners in distress, particularly those impacted by unemployment or the COVID-19 pandemic.

It’s crucial for homeowners facing foreclosure to familiarize themselves with their state’s laws and seek professional advice as soon as possible. Whether through state-specific assistance programs, loan modifications, or legal defense, homeowners have options to help stop foreclosure and regain control of their financial future.

Brief conclusion

While foreclosure can seem like the inevitable outcome of financial distress, there are numerous steps you can take to prevent it. Whether it’s through loan modifications, government assistance programs, legal protections, or exploring alternatives like short sales or deed-in-lieu of foreclosure, homeowners have several options available to them. The key is to act quickly, communicate with your lender, and seek professional help when needed.

By being proactive and understanding the full range of options available, you can protect your home and your future. Don't let foreclosure define your financial journey—take action now to preserve your home and regain control of your finances.